DataReddit

DataYahooFinanceDJIA

DataYahooFinanceDanskeBank

RedditWordCloud

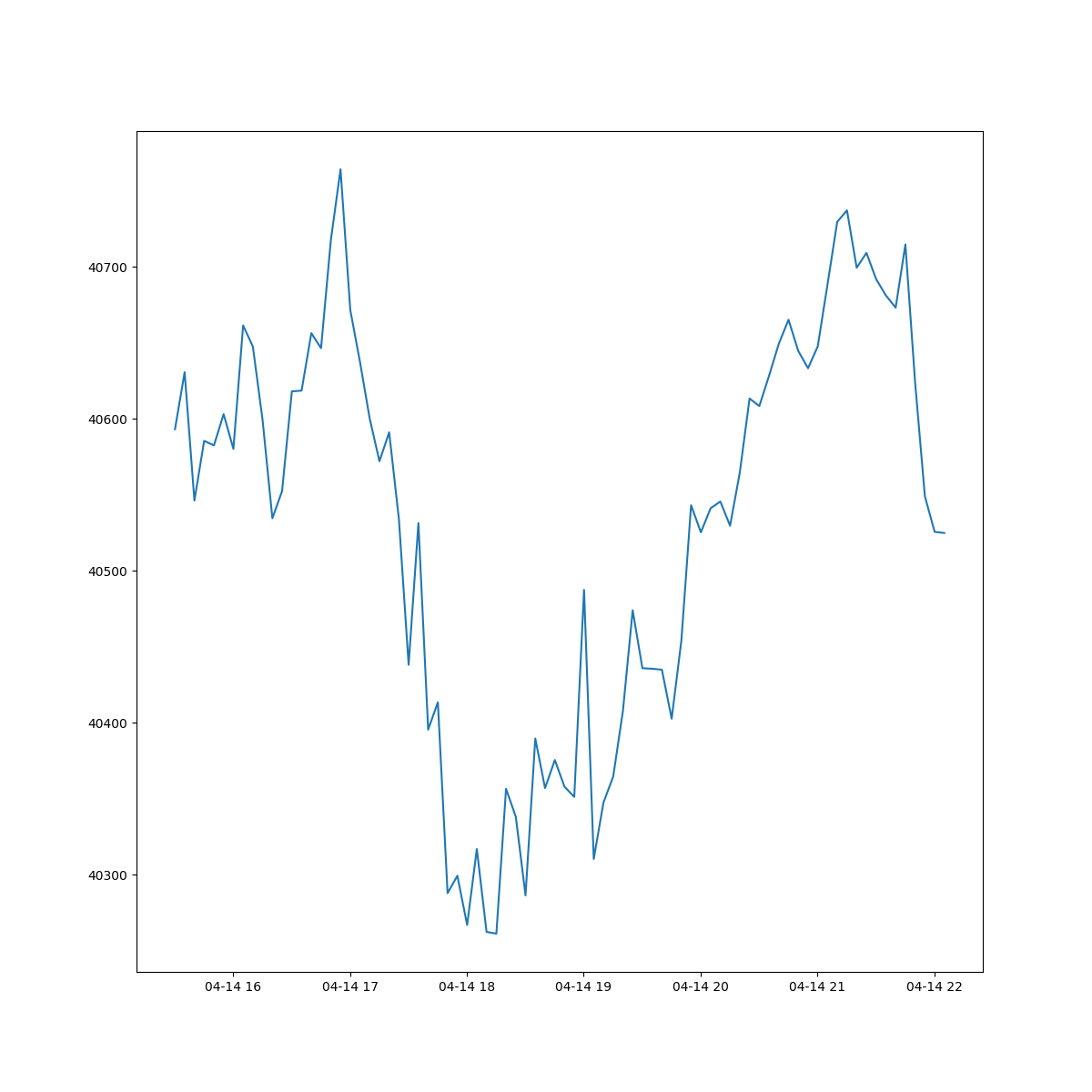

StockCurve

VaR

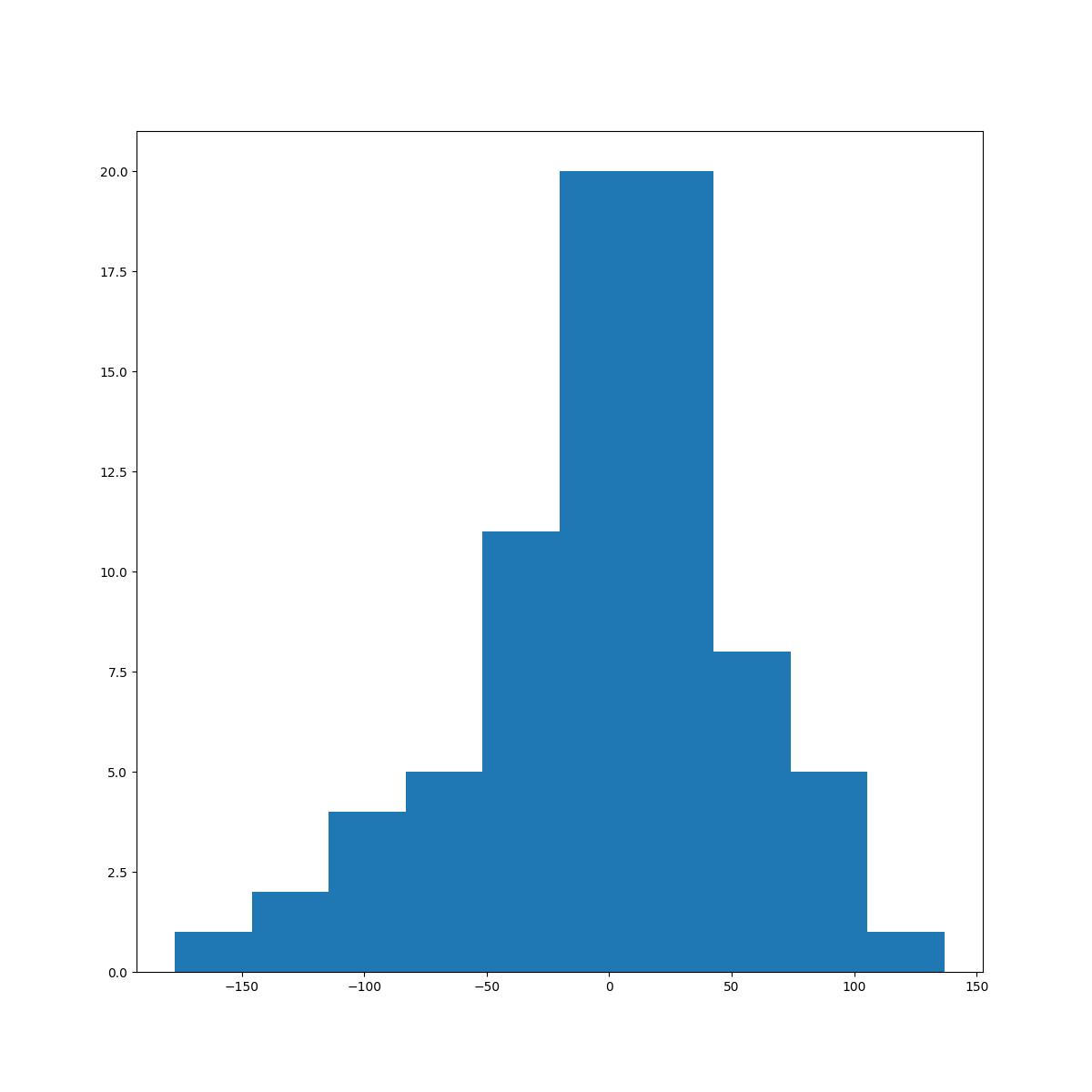

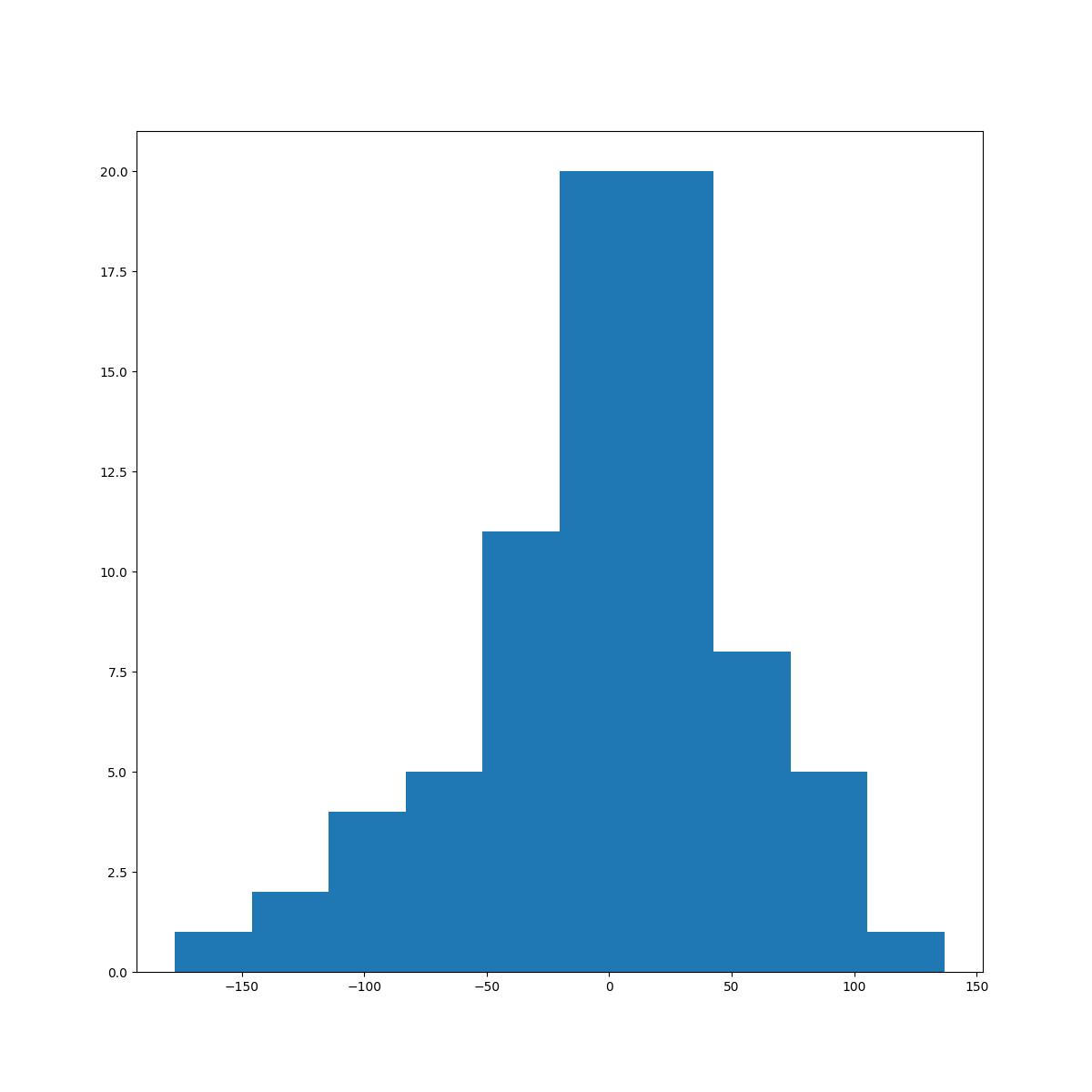

Value at Risk for Dow Jones Industrial Average (^DJI) stock price (USD)

Value at Risk for Dow Jones Industrial Average (^DJI) stock price (USD)

Value at Risk: computed with 5-minutes intervals spanning a full day of open market hours, the 5% 1-day VaR is in amount,

-125.88832011659499077038804

Description: one stock is assumed as market variable. It is assumed that percentage changes during time of historical data are the same as percentage change to the next, V_n, unknown market value V_n/V_(n-1) = V_i/V_(i-1). Historical data is taken from a stock price curve shown on second figure. An estimate for a 5% 10-day VaR can be computed as sqrt(10) times a 5% 1-day VaR.

Histogram of Losses and gains

Description: losses have been computed for every scenario derived by subtracting V_(n-1).

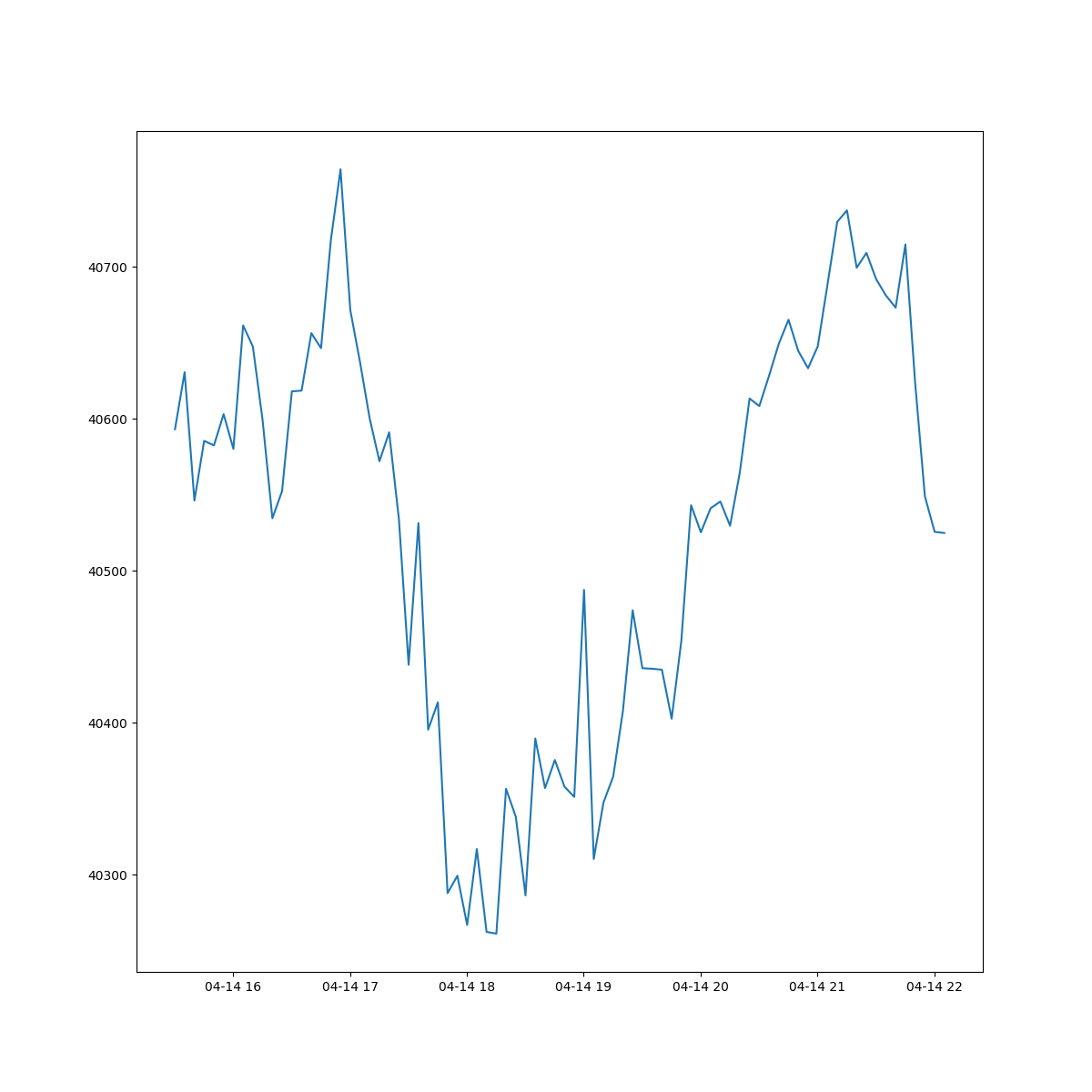

Stock price

Description: historical data is taken from a stock price curve during open market hours where scraping was done every 5 minutes.